* Profit (loss) attributable to the Owners of the Parent

** Equity attributable to the Owners of the Parent

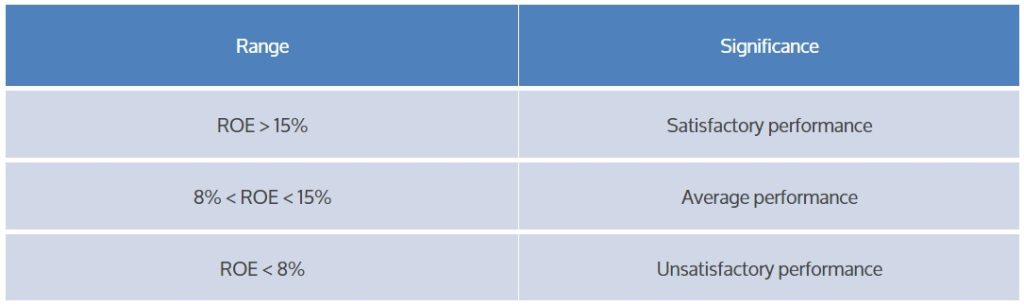

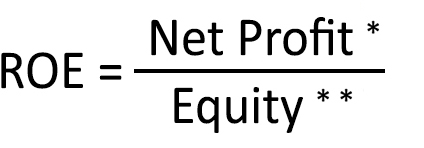

ROE measures the overall profitability of the Equity capital invested in the company and provides a benchmark to evaluate alternative investments.

ROE indicates the return on capital invested by the shareholders or by the entrepreneur. In other words, is the result of accrued interest, generated by the business activity, on the Equity invested in the company. This way it allows the shareholder, actual and potential, to measure the convenience to invest Equity capital in a company rather than another one. An enterprise, in order to attract new capital, should provide a greater ROE compared to the rates of return of alternative investments.

Whatever the case, the ROE of a company should never be lower than the guaranteed yield of risk-free investments. Below this limit, in fact, the risk of investors/shareholders would not be remunerated fairly. In case of loss, the ROE is negative. This means that economic imbalance is so severe that a portion of the Equity is eroded. An alternative form of calculus leads to a Gross ROE, that considers Income Before Tax as the numerator of the formula. In doing so the yield is not affected by fiscal policy. The ROE can be useful when comparing gross profitability of companies operating in different countries or in areas where the tax system applied is uneven. To be more precise, the Equity could be calculated by taking the average of Equity held by a company at the beginning of the year and at the year’s end.