Online financial planning software for Start-Ups

Business Plan for Start-ups software is a comprehensive professional solution to create a financial plan for start-up projects, compliant with IFRS/GAAP accounting standards. The application assists in developing forecasts, selecting appropriate funding sources, and defining growth objectives to maximize value. You can plan up to 10 years of business activities, with annual and monthly details and multi-scenario sensitivity analyses. The system automatically generates a customizable financial report, complete with ratios, charts, graphs, and comments discussing the company’s expected performance and projections.

TURN YOUR IDEA INTO A PROFESSIONAL BUSINESS PLAN

-

- Very simple and user-friendly data input interface. Financial modeling made easy, no matter if you are a finance pro or just a beginner

-

- All financial statements and essential startup KPIs (Balance Sheet, Profit & Loss Statement, Cash-flow Statement) are generated automatically

-

- The software suggests corrections and interventions to enhance performance

-

- Simplify the simulation of the economic-financial impacts of devised strategies and forecasts, assessing their profitability and bankability

-

- Calculate 35 commented financial ratios categorized into the four management areas with industry-specific benchmark data

Automatic Reporting

Automatic reporting

Automatic dynamic comments

Downloadable and editable

Download formats

Designed either for Finance Pros and Beginners

Business Plan for Start-ups has been developed for accountants, corporate lawyers, entrepreneurs, banks, CFOs (Chief Financial Officers), financial analysts, managers, economists, shareholders needing to analyze business performances of companies and supports start-up founders with fundraising, financial modeling, creating budgets and cash flow projections. It is an essential application for:

- Economic and financial analysis of both listed and unlisted companies;

- Effective financial communication to stakeholders, through a professional and fine report;

- Startup founders;

- Creditworthiness assessment and company rating;

- Investment and financing decisions by managers or external stakeholders.

How it works

Yet it makes extensive use of sophisticated business data processing methods, Financial Statement Analysis is extremely easy to use and does not require any particular expertise, apart from some basics in IFRS and GAAP accounting.

Users simply have to enter assumptions data and the application generates up to ten years of financial projections. The system highlights technical or logical mistakes in the entered data and makes a series of recommendations to improve performances. It develops a thorough analysis and generates a final report on the company’s health.

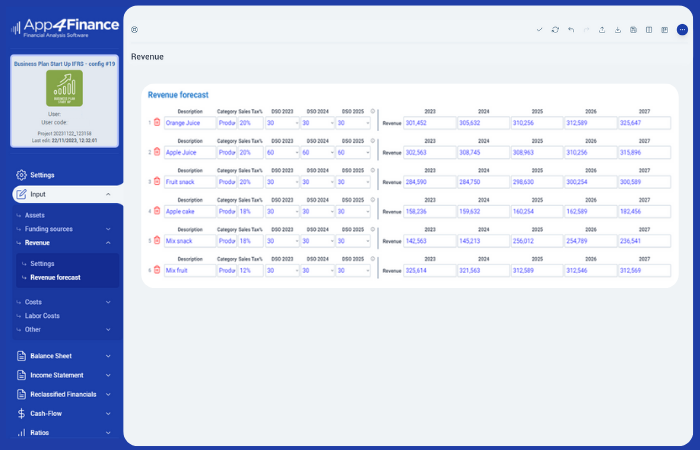

INPUT - Assets, Founding sources, Revenue & Costs

Plan the acquisition of durable assets necessary to drive the business.

Select and size the sources of financing: you can enter either Equity and borrowings. Long-term loans and short-term credit lines in the form of cash credit or cash advances.

Develop revenue and costs forecasts for each year of the plan. You can arrange each revenue source and costs into categories that you can create as you wish. Enter the amount, the sales tax rate, and the payment days. If you choose to manage the plan with monthly detail, you will be able to input the revenue of each category for every month.

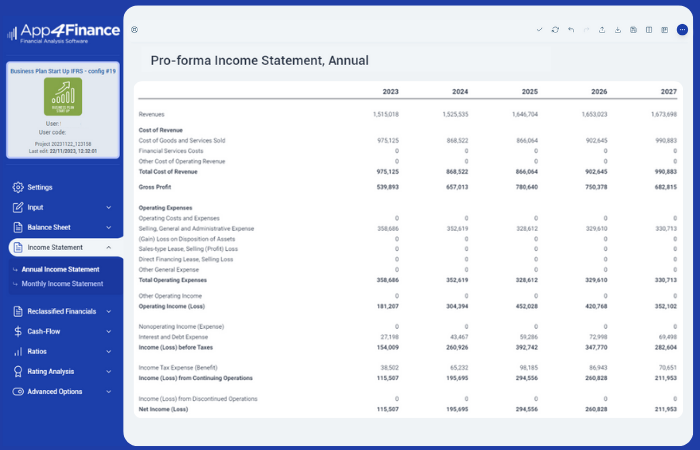

PRO-FORMA FINANCIAL STATEMENT

All financial statements (Balance Sheet, Profit & Loss Statement, Cash-flow Statement) are automatically generated, based on the input assumptions, compliant with the IFRS/GAAP accounting standard, with monthly and annual details.

RECLASSIFIED FINANCIALS

Balance Sheet tables reclassified and aggregated according to liquidity (Financial Balance Sheet) and based on a functional arrangement (Functional Balance Sheet) separating operating activities from financing.

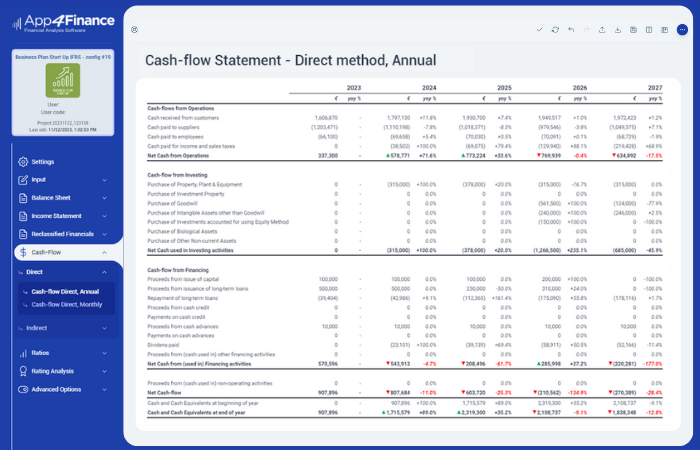

AUTOMATIC MONTHLY CASH FLOW FORECASTING

“Cash is king” and projecting cash-flows is essential to assess the viability of the project. The software automatically generates monthly cash-flow projections. Based on your forecast all cash in-and outflows are listed on a monthly basis in our cash flow overview, making it easy for you to spot potential liquidity problems that can lead to bankruptcy.

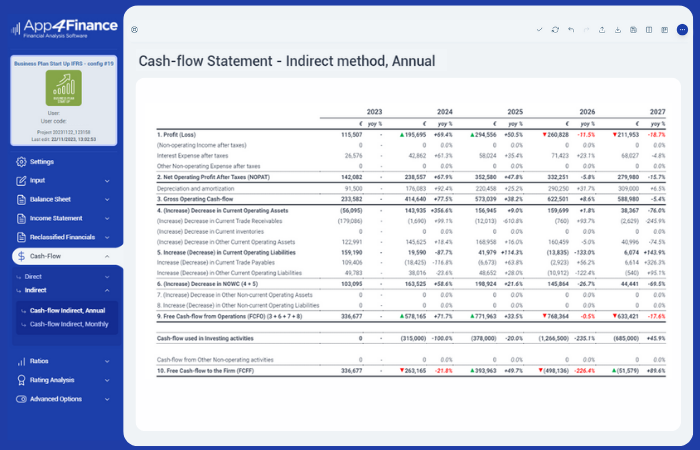

STATEMENT OF CASH-FLOWS

A direct cash-flow statement is generated, along with a statement based on the indirect method, highlighting the trend in Net Operating Working Capital and the Free Cash-flow, to be discounted to compute NPV.

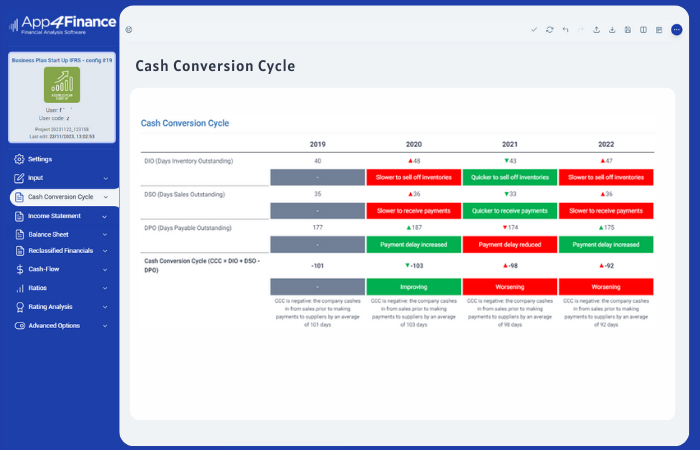

WORKING CAPITAL ANALYSIS

Net Working Capital and Net Operating Working Capital (NOWC) are projected over the entire forecast period to evaluate the expected operating cycle.

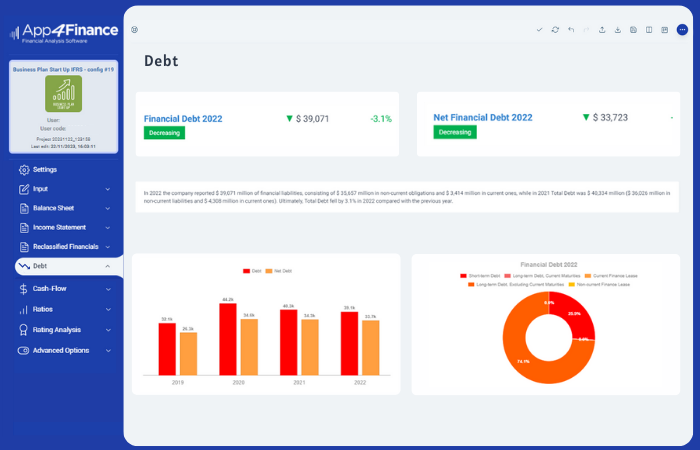

DEBT

Projections of long- and short-term financial debt providing essential insight on the utilization of credit lines and long-term borrowings.

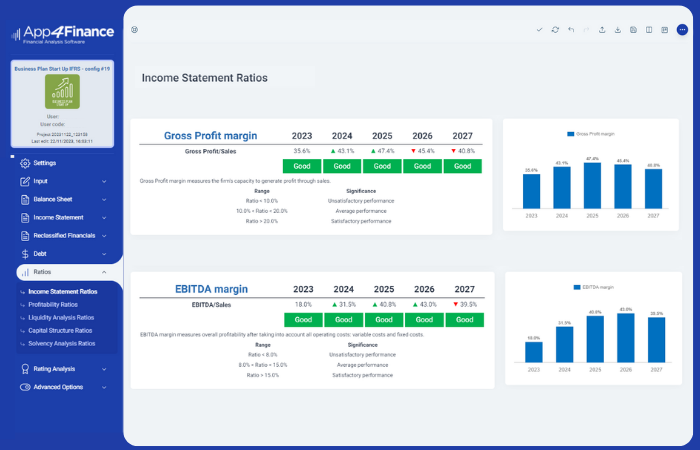

RATIOS

A wide range of basic financial ratios, based on the pro-forma financial statements evaluating the expected financial performance in terms of profitability, capital structure, liquidity and solvency.

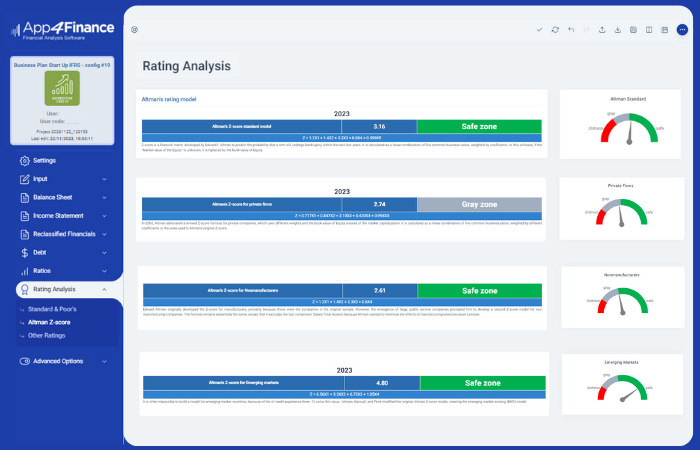

RATING E SCORING

Standard & Poor’s rating, Altman’s Z-score, Taffler’s score, Springate’s rating model are implemented for each of the projected year in order to assess the company’s expected solvency.

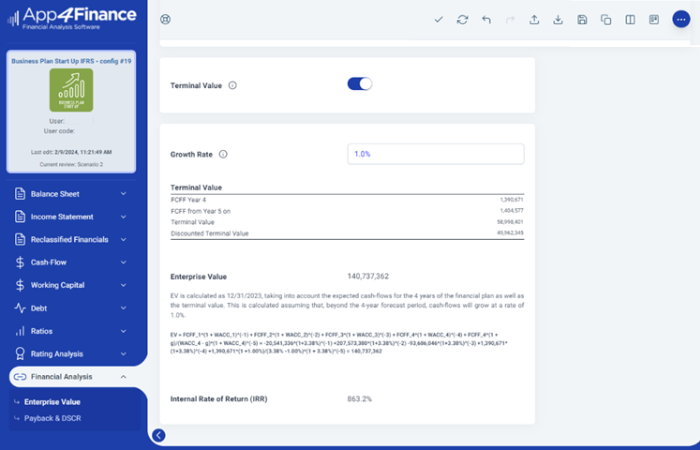

FINANCIAL ANALYSIS: NPV & IRR

In this section, the software automatically calculates the EV (Enterprise Value) and the IRR (Internal Rate of Return). An internal database provides the necessary data for calculating the WACC (Weighted Average Cost of Capital) including the Risk-Free Rate, Equity Risk Premium, Levered and Unlevered Beta, which will be used to discount the projected cash-flows. All parameters can be customized. In addition, the application evaluates the Payback Period and the DSCR (Debt Service Coverage Ratio).

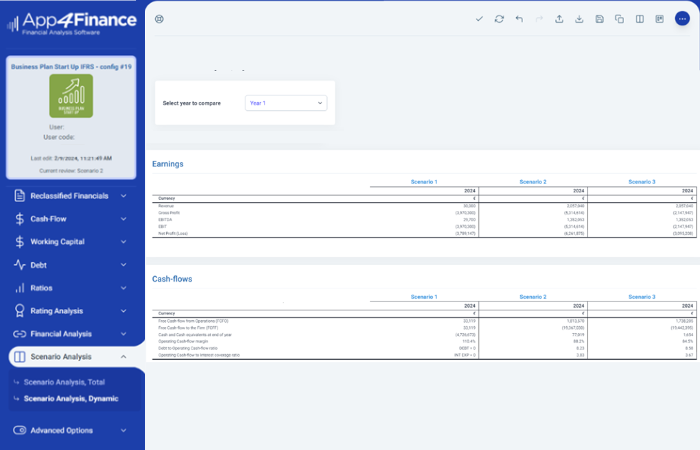

MULTIPLE SCENARIO ANALYSIS

Once the main forecast is completed, it will be possible to create various alternative scenarios in which one or more assumptions can be varied (for example, slightly lower revenues or higher costs). In this way, a sensitivity analysis can be implemented, stress-testing the project according to possible changes in the competitive landscape. The different scenarios can be displayed simultaneously for all the years of the plan or just for a specific year.

AUTOMATIC FINANCIAL PLAN

Create automatically a fully customizable financial report in Word or pdf format and export all data to an Excel spreadsheet. Thanks to sophisticated business intelligence algorithms, the report is rich in ratios, charts, graphs, and comments and it is ready to share with and use to inspire, investors, co-founders, partners or your management team.

Automatic Reporting

Automatic dynamic comments The system, through complex business intelligence algorithms, generates automatic comments discussing the company’s performance and rating.

Downloadable and editable The report can be downloaded on your own device and edited according to your needs.

Download formats The report can be downloaded in: Word file, Excel spreadsheet and Pdf.

IFRS

GAAP

1 month

€

Discount of %

- No Contracts/No Automatic Renew

- Professional Support & Continuous Updating

- Unlimited Projects & Automatic Reporting

- Share Projects And Simultaneous Access With Your Staff

- Automatic Financial Analysis Whatif, Multi-Scenario, Multi-Company, Benchmark

- Customizable Reports, Available In Docx, PDF And Excel

3 months

€

Discount of %

- No Contracts/No Automatic Renew

- Professional Support & Continuous Updating

- Unlimited Projects & Automatic Reporting

- Share Projects And Simultaneous Access With Your Staff

- Automatic Financial Analysis Whatif, Multi-Scenario, Multi-Company, Benchmark

- Customizable Reports, Available In Docx, PDF And Excel

12 months

€

Discount of %

- No Contracts/No Automatic Renew

- Professional Support & Continuous Updating

- Unlimited Projects & Automatic Reporting

- Share Projects And Simultaneous Access With Your Staff

- Automatic Financial Analysis Whatif, Multi-Scenario, Multi-Company, Benchmark

- Customizable Reports, Available In Docx, PDF And Excel

monthly payments

12 months

€

Discount of %

- No Contracts/No Automatic Renew

- Professional Support & Continuous Updating

- Unlimited Projects & Automatic Reporting

- Share Projects And Simultaneous Access With Your Staff

- Automatic Financial Analysis Whatif, Multi-Scenario, Multi-Company, Benchmark

- Customizable Reports, Available In Docx, PDF And Excel

1 month

€

Discount of %

- No Contracts/No Automatic Renew

- Professional Support & Continuous Updating

- Unlimited Projects & Automatic Reporting

- Share Projects And Simultaneous Access With Your Staff

- Automatic Financial Analysis Whatif, Multi-Scenario, Multi-Company, Benchmark

- Customizable Reports, Available In Docx, PDF And Excel

3 months

€

Discount of %

- No Contracts/No Automatic Renew

- Professional Support & Continuous Updating

- Unlimited Projects & Automatic Reporting

- Share Projects And Simultaneous Access With Your Staff

- Automatic Financial Analysis Whatif, Multi-Scenario, Multi-Company, Benchmark

- Customizable Reports, Available In Docx, PDF And Excel

12 months

€

Discount of %

- No Contracts/No Automatic Renew

- Professional Support & Continuous Updating

- Unlimited Projects & Automatic Reporting

- Share Projects And Simultaneous Access With Your Staff

- Automatic Financial Analysis Whatif, Multi-Scenario, Multi-Company, Benchmark

- Customizable Reports, Available In Docx, PDF And Excel

monthly payments

12 months

€

Discount of %

- No Contracts/No Automatic Renew

- Professional Support & Continuous Updating

- Unlimited Projects & Automatic Reporting

- Share Projects And Simultaneous Access With Your Staff

- Automatic Financial Analysis Whatif, Multi-Scenario, Multi-Company, Benchmark

- Customizable Reports, Available In Docx, PDF And Excel

Subscription fee includes:

Customer Support

Automatic Reporting

Unlimited Projects