Financing – decisions and operational policies by which companies raise the necessary resources to support and develop the business, can seriously jeopardize the very survival of the company. Keep tabs on the amount of debt, especially in relation to the ability to bear the cost and to raise in the course of time the resources to repay lenders, is a top priority for any finance manager.

The model we propose assesses the risk of insolvency through two complementary analyses:

1) determination of the level of debt in relation to shareholders’ Equity of the company;

2) assessment of the company’s ability to generate sufficient financial income to meet debt service.

The first passage will help you understand whether the financial structure of the company is balanced or whether, by contrast, is too skewed towards external funding sources. The second is essentially a solvency analysis, the purpose of which is to clarify if the company is able to support through their own incomes the financial structure that you are given.

Recurring purely to accounting indicators, this methodology requires neither specific data concerning liabilities repayment schedules, nor analytical statements of cash flows. You only need some income and asset information, which can be found either by financial statements or by forecast plans.

Please find in detail how to proceed operationally:

1) Valuation of the stock of debt

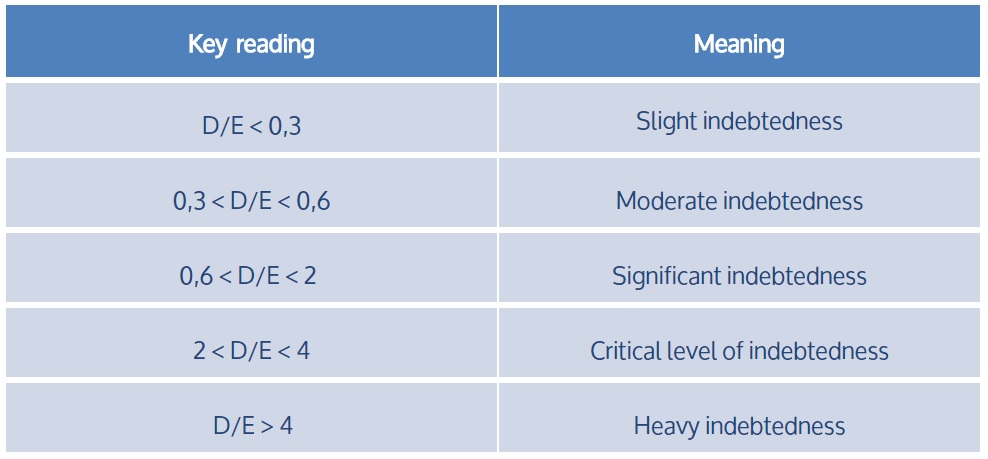

D/E ratio is used, which relates the borrowed capital to Equity of the company. The data can be made equal to the carrying amounts recorded in the last budget. For a more thorough assessment should in principle take account of the specific nature of the industrial sector, it is possible to identify substantive bands sufficiently general to frame the extent of indebtedness.

2) Debt Sustainability Assessment

Take into consideration the following two indicators:

– Debt/EBITDA

– EBITDA/financial expenses

The first relates the total financial liabilities with annual operating income of the company and can be regarded as the expected number of years that the company will employ to fit spaces of its exposure. The second index, instead, checks directly the cost of debt, through the ratio between operating income to the amount of borrowing costs.

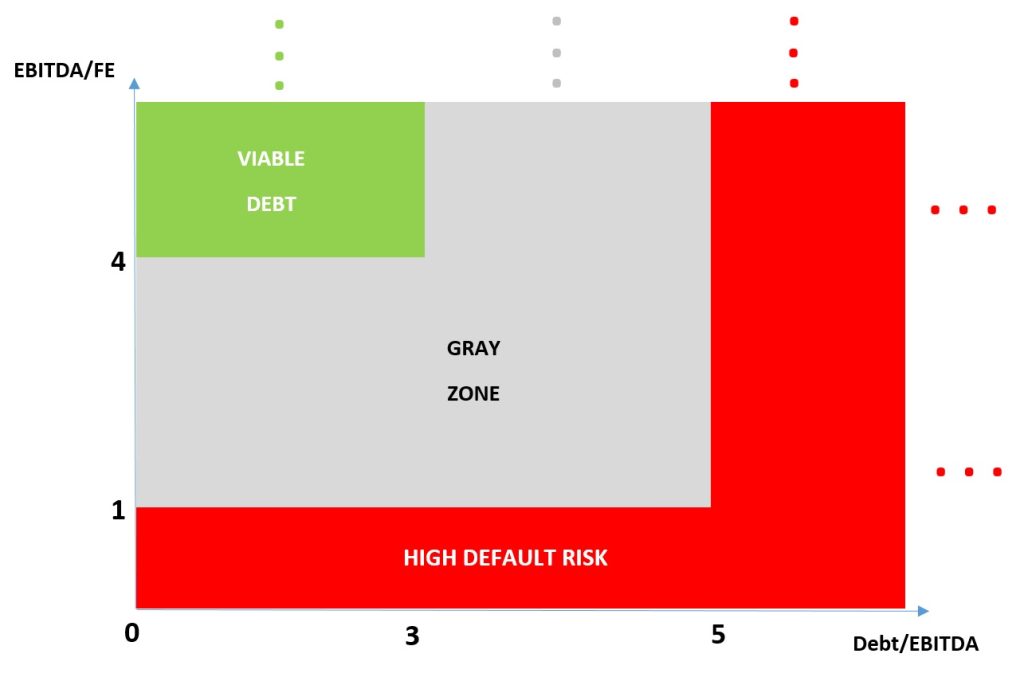

Debt/EBITDA ratio should ideally be kept as low as possible. Values less than 3 are generally accepted as indicating of a condition of financial equilibrium, while values greater than 5 denote a non-negligible risk of creditworthiness.

The ratio EBITDA/financial expenses, on the contrary, must assume values as high as possible, say greater than 4 to ensure adequate coverage of costs of debt. Values of less than unity indicate clearly a condition of absolute imbalance, as operating income would not be enough even to cover the interest on the debt.

Once calculated the two indicators, it is possible to identify three bands of merit: an area of debt sustainability, an area of high risk of insolvency and between the two, a grey zone in which will fall companies for which data do not allow for predictions with due certainty.

Sustainability: we will include in the first substantive range those companies for which the debt-to-EBITDA is less than 3 and simultaneously the ratio EBITDA/financial expenses exceeds 4.

High risk of insolvency: we will put a serious default risk to those companies for which even one only of the two parameters falls into a risk range, namely: Debt/EBITDA exceeding 5, EBITDA/financial expenses less than 1.

Grey zone: remaining cases.

Conclusions

In the evaluation of the debt, it is necessary to consider both the question of financial structure and creditworthiness. Indebtedness of considerable proportions does not necessarily compromise the survival of the company itself. There are companies with a strongly unbalanced yet sustainable structure and businesses with modest leverage that can under certain circumstances undergo a serious risk of default. For this reason it is recommended that a methodology based on a joint assessment of the magnitude and sustainability of leverage is used to highlight critical issues and to guide management decisions.