Working Capital: what it is and how to calculate it. A comparison of the different methods used.

Standard method

Net Working Capital (NWC), often referred to simply as Working Capital, is a measure of a company’s liquidity, indicating its ability to meet short-term obligations and is an indicator of its financial health at a given point in time. In general terms, NWC is calculated as the difference between the value of current assets and the value of current liabilities using the following formula:

NWC = Cash & Cash Equivalents + Inventories + Accounts Receivables + Prepaid Expenses + Other Current Assets – Accounts Payables – Current Debt – Deferred Revenue – Other Current Liabilities

All items included in the Net Working Capital are current assets and liabilities, meaning they are expected to be converted into cash, either incoming or outgoing, within the operating cycle period.

Evaluation of NWC

NWC can be either greater or less than zero. A positive NWC (i.e., current assets are greater than current liabilities) indicates that the company has resources to meet short-term liabilities and the capacity to invest in future growth initiatives. However, a high NWC level is not always positive as it could indicate that a company has excessive inventory or has not invested its excess liquidity. For example, a positive NWC could signal a financial imbalance due to:

- Poor inventory turnover

- Long collection periods or difficulties in collecting from customers

- Excess liquidity

- Very short supplier payment terms

A negative NWC (i.e., current liabilities exceed current assets) indicates that a company might struggle to repay creditors, which could limit growth and, in severe cases, threaten business continuity. However, a negative NWC does not always mean there are issues, as the company might collect payments from customers very quickly or immediately, anyway faster than it takes to pay suppliers (e.g., retail companies). In this case, NWC might be negative because short-term liabilities exceed short-term receivables, with the company investing the generated liquidity in other investments.

Formulas for Net Working Capital

Various formulas are used to calculate NWC depending on the analysis purpose and desired outcome.

1. Net Working Capital

- Formula: Current assets – Current liabilities

NWC = Cash & Cash Equivalents + Inventories + Accounts Receivables + Prepaid Expenses + Other Current Assets – Accounts Payables – Current Debt – Deferred Revenue – Other Current Liabilities

This formula, also known as Financial NWC, is the broadest as it includes all accounts classified in the balance sheet as current assets or liabilities, regardless of their nature. Either operating, financial and non-operating items are included (e.g. trade receivables and financial ones are both included).

| Assets | Liabilities |

| Cash and Cash Equivalents | Current Accounts Payables |

| Short-term Investments | Current Accrued Liabilities |

| Other Current Financial Assets | Short-Term Debt |

| Current Accounts Receivables | Long-Term Debt, Current Maturities |

| Current Financing Receivables | Other Current Financial Liabilities |

| Non-trade and Other Current Receivables | Current Deferred Revenue |

| Current Inventories | Current Deferred Compensation Liabilities |

| Current Prepaid Expense | Other Current Liabilities |

| Current Contract with Customer | |

| Current Deferred Costs | |

| Other Current Assets |

2. Net Operating Working Capital (NOWC)

- Formula: Inventories + Trade Receivables + Prepaid Expenses + Other Current Operating Assets – Trade Payables – Deferred Revenue – Other Current Operating Liabilities

This formula excludes all financial items and accounts not being associated with everyday business operations, such as cash, short-term investments, financial receivables, financial payables and every non-operating item. Receivables and payables are classified based on their participation in the company’s operating cycle, defined as the time between acquiring goods for the production process and realizing them into liquid assets or equivalents. All assets and liabilities generated during a company’s operating cycle are considered current assets/liabilities. This formula excludes immediate liquidity, financial receivables, and financial payables.

| Assets | Liabilities |

| Current Accounts Receivables | Current Accounts Payables |

| Current Inventories | Current Accrued Liabilities |

| Current Prepaid Expense | Current Deferred Revenue |

| Current Contract with Customer | Current Deferred Compensation Liabilities |

| Current Deferred Costs | Other Current Operating Liabilities |

| Other Current Operating Assets |

|

|

Cash & Equiv’ |

Financial Assets |

Trade Receivables |

Inventory |

Trade Payables |

Debt |

Financial Liab’s |

Accruals |

|

NWC |

✓ |

✓ |

✓ |

✓ |

✓ |

✓ |

✓ |

✓ |

|

NOWC |

✗ |

✗ |

✓ |

✓ |

✓ |

✗ |

✗ |

Operating |

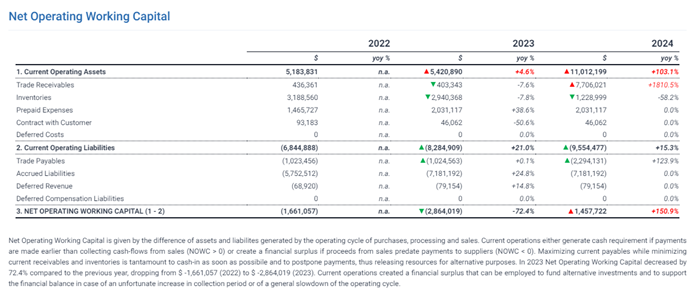

THE IMPORTANCE OF NOWC

Analyzing NOWC and its trends over the years allows to focus on the cash requirement generated by operating activities and compare it against the funding sources. Therefore, the selection of the involved items must consider their nature, distinguishing between the company’s core and non-core activities.

To perform this analysis, all operating items must be considered, disregarding their temporal profile. The operating cycle is defined as the period of time between the acquisition of goods for the production process and their conversion into liquid assets or equivalents through sales. By definition, all assets and liabilities generated during this cycle are considered current, regardless of their maturity, and contribute to NOWC calculation. Thus, trade receivables from the sale of goods typical of the production cycle, even if collected beyond 12 months, will always be considered current. Non-operating items like liquid assets, financial receivables, and payables are excluded from NOWC as they are considered financing sources to cover potential NOWC cash requirements.

Besides liquid assets and financial receivables/payables, the following are excluded from NOWC:

- Non-operating investments like securities

- Non-sales-related receivables: receivables from shareholders, bondholders, or third parties for the sale of fixed assets, etc.

- Non-purchase-related payables: short-term payables to suppliers of fixed assets, payables to shareholders for declared dividends, etc.

- Tax-related payables and receivables unrelated to purchases and sales

By analyzing NOWC, we can compare and assess two crucial values for business continuity:

- Financial requirement

- Funding sources

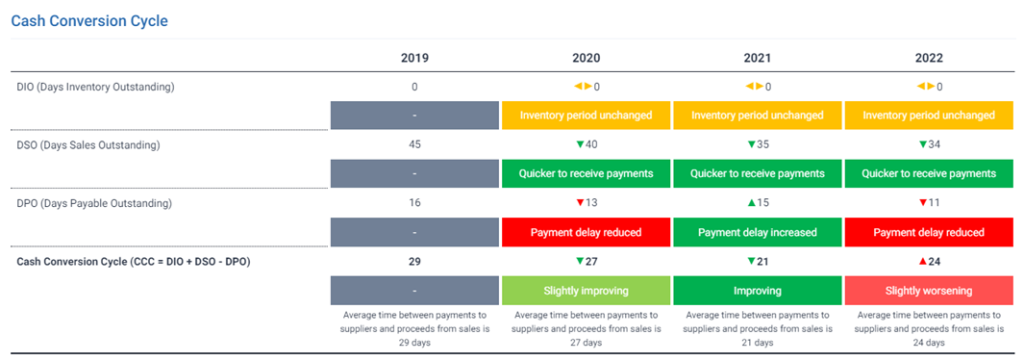

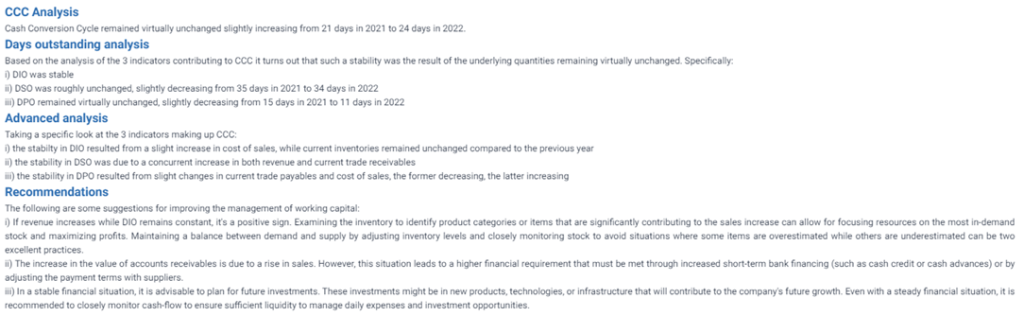

Therefore, liquidity ratios like the Current ratio and the Quick ratio, based solely on the entirety of current assets and liabilities, must be integrated with the analysis of operating working capital (NOWC). NOWC is influenced mainly by two factors: sales and cash conversion cycle (CCC). Increased sales lead to higher receivables, inventories, and associated production costs, consequently generating higher payables. Generally, increased sales will raise NOWC and thus the associated financial requirement. Cash requirement will also increase due to an extended cash conversion cycle. For instance, higher sales resulting from extended payment terms to customers make the company’s products more attractive compared to competitors.

Unlike liquidity ratios, an increase in payables, with constant receivables and inventories, reduces the financial requirement. This is true because delayed payments reduce the immediate need for funds, but understanding the reasons behind increased payables is crucial. If it stems from greater bargaining power, that’s beneficial; however, if due to a lack of resources, it could lead to significant operational issues as suppliers may stop providing goods, disrupting the production process and business continuity.

Hence, there’s no direct relationship between liquidity ratios and NOWC as they serve different purposes. The former assess if the company can repay short-term liabilities with short-term resources, while NOWC allows for a more advanced analysis of business dynamics, enabling even the construction of a predictive model.

NOWC Evaluation

A straightforward evaluation based on NOWC alone is not feasible. Generally:

- NOWC > 0 indicates financial needs that must be met through resource acquisition as investments in receivables and inventory exceed financing from suppliers.

- NOWC < 0 indicates a surplus of resources, negating the need for coverage sources.

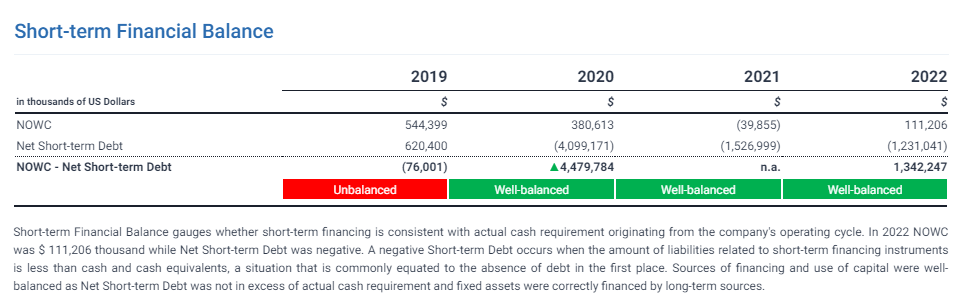

However, this isn’t always true. To evaluate the financial management of a company, NOWC must be compared with three other values:

- Short-term financial sources (credit limit on short-term credit lines) to determine if financial needs can be met

- Credit utilized, net of available cash

- Cash cycle analysis to understand what generated the NOWC requirement in the first place

For the first point, the following equation should be met:

Credit limit > NOWC

This prevents liquidity crises due to unmet financial needs. If unmet, the company must find alternative funding sources. However, even with available credit lines, the financing cost (interest rates and bank charges) should be lower than the return on invested capital:

ROI > Cost of debt

Next, analyze the balance between sources and uses through the equation:

NOWC > Credit utilized, net of available cash

Ensuring that long-term needs (e.g., asset purchases) aren’t financed with short-term sources like credit lines. Considering existing liquid assets, this can be rewritten as:

NOWC > Credit utilized

|

NWC |

NOWC |

|

+ Cash and Cash Equivalents + Short-term Investments + Other Current Financial Assets + Trade Receivables + Financing Receivables + Other Current Receivables + Inventories + Other Current Assets – Trade Payables – Accrued Liabilities – Current Debt – Other Current Financial Liabilities – Other Current Liabilities |

+ Trade Receivables + Inventories + Prepaid Expenses + Contract with Customer + Deferred Costs + Other Current Operating Assets – Trade Payables – Accrued Liabilities – Deferred Revenue – Other Current Operating Liabilities |

|

Pros A widely used figure due to its immediate calculation and its lack of reliance on interpretations regarding the nature of the accounts |

Pros It estimates cash requirement and its sources of funding |

|

Cons It doesn’t evaluate the cash requirement and its sources of funding |

Cons It is not always easy to define the operating nature of individual items solely from the financial statements |

|

Figure |

Positive if |

Negative if |

|

NWC |

NWC > 0, also evaluate Current ratio |

NWC < 0, also evaluate Current ratio |

|

NOWC |

NOWC < 0, with NOWC > Net Credit used & NOWC < Credit limit, also evaluate CCC |

NOWC > 0 NOWC < 0 with NOWC < Net Credit used & NOWC > Credit limit, also evaluate CCC |

Discover all the features of the software. Request a video call demo with one of our consultants right away.