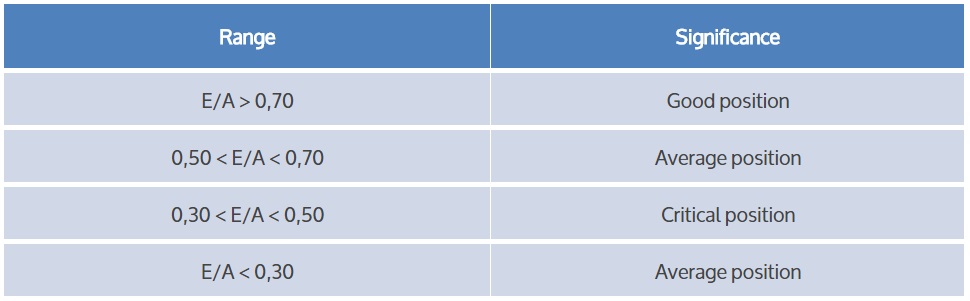

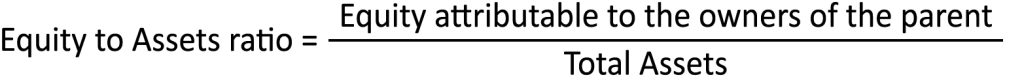

The Equity to Assets ratio holds significant importance in evaluating the financial health and long-term profitability of a corporation. This metric is a staple for investors seeking insights into the safety of investing in a company’s shares, serving as a crucial indicator of solvency.

This ratio assesses the degree of financial independence, offering a glimpse into what percentage of the company’s total assets is financed by equity. A high ratio implies that the corporation is predominantly owned by its shareholders, enabling it to pay reduced interest on debt. In contrast, a low ratio suggests that the corporation may be burdened with substantial debts, making it challenging to secure loans from banks and other financial institutions.

While a low Equity to Assets ratio might signal financial challenges, it is not necessarily detrimental. In fact, it can contribute positively to the Return on Equity (ROE). This dynamic becomes beneficial when the company earns a rate of return on its assets that exceeds the interest rate paid to creditors. In such cases, a lower ratio reflects a strategic approach, emphasizing efficient debt management and the potential for higher returns on assets.

Investors leverage the Equity to Assets ratio as part of their due diligence, using it as a key factor in assessing the overall financial stability and growth prospects of a corporation. By understanding the balance between equity and total assets, investors can make more informed decisions about the safety and potential profitability of their investments.

In conclusion, the Equity to Assets ratio serves as a vital tool for investors and financial analysts alike, providing valuable insights into a corporation’s financial structure, risk profile, and potential for sustained profitability. It is a metric that goes beyond simple solvency assessment, offering a nuanced perspective on the relationship between ownership, debt, and financial performance.